The “Haves and the Have Nots” is an American prime time television soap opera created and directed by Tyler Perry. The series was renewed for a fourth season of 23 episodes, which will premiere on Tuesday, January 5, 2016. According to Variety, The drama series has been acclaimed as being “one of OWN’s biggest success stories with its weekly dose of soapy fun, filled with the typical betrayals, affairs, manipulations, and a bitch slap or two.”

In 2015, it has been a feel good season for Virtual Reality. Everybody’s been nice to each other. There’s a lot of collaboration and alliances in how the nascent market is being developed. What happens as this market really develops into the pundit’s projections of $20 Billion by 2020? Could we see some soapy fun, typical betrayals, manipulations and bitch slap or two?

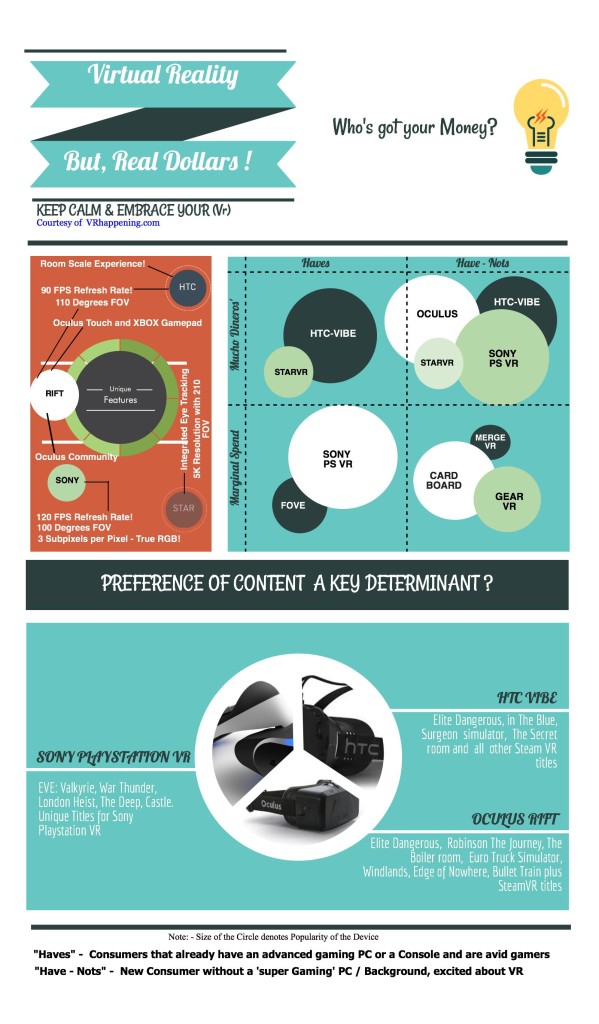

More importantly, how would it affect the average consumer and his purchasing decisions? In my opinion, there are two main types of consumers for this market place. The “Haves”; These are the market participants that have had prior gaming experience or owned a gaming PC and or a console for quite some time. Then there are The “Have-Nots”, who although may have dabbled in some gaming at a friends place but have not made any serious investment into a gaming PC or the latest gaming console. They are interested in “Gaming and Beyond” applications of virtual reality.

Both the “Haves” and the “Have-nots” can also be characterized by their propensity to spend money on VR. There are the consumers who want to invest marginally to experience VR and then there are the true enthusiasts that have been waiting forever for this onslaught of “full-dive” experience who are willing to spend the market price to experience. One key aspect of determining which camp you want to be a part of and who eventually gets your money is to understand the strategic intent of the offering. A lot has been discussed around the product features on multiple web sites, so I will not dive into the core technical characteristics of the headsets.

Let’s look at a few of the players and their recent moves.

Samsung partnered up with Oculus for the Gear VR and was the first to come to the market with a product that has developed consumer appeal. During the same time as it focused its resources in developing Gear VR, It has also been strategically investing in other VR headset manufacturers.

Samsung Ventures invested in FOVE, which is essentially a high-end headset that uses eye tracking and is expected to cost three to four times as much as the Gear VR. Samsung Ventures also partnered up with Ashton Kutcher and invested in an upcoming VR start-up based out of New Zealand called 8i. 8i’s mission is to enable everyone to connect with each other in the closest way to real-life. 8i enables true 3D (fully volumetric) capture of people, allowing viewers to walk around real humans in VR.

In a way, Samsung is betting on its Gear VR’s positional tracking as well as intends to see how the eye-tacking via FOVE plays out in the future. Unlike Playstation VR or Oculus, FOVE’s device can work off a normal PC with a dedicated graphics card and a mini display port output. You will also not be required to make a significant investment into a “Rift spec PC”.

Samsung has also partnered with eye tracking company Seeing Machines. The companies intend to pursue eye and face tracking together. I would guess that if the momentum continues to build via Gear VR, one could expect a new Gear VR that provides some eye tracking and other advanced features. Infact, at one point, Samsung’s Andrew Jackson suggested that possibility via Twitter.

Building upon this first mover’s advantage will definitely position Samsung as a powerhouse in the Mobile VR market. If at some point soon, Samsung can sell more Galaxy’s 6 and 7s by packaging Gear VR, One will only expect that the current level of investment in VR will continue for Samsung. The primary intent, however is to sell more Smartphones and tackle the issue of lost market share against Apple. Given that they have a new chief (announced this week), it will be important to see what direction and how much resources Samsung commits to VR.

Either way, if you are a “Have-Not” and intend on investing marginally for a pretty decent VR experience via mobile, Samsung is a great choice for now. If the VR Mobile momentum picks up next year and I bet it will, there will be new offerings in the market that will allow you to experience “good” Mobile VR even if you do not have a Samsung mobile device. This is also an area where you can expect quite a bit of “Beyond Gaming” VR experiences in the near future.

Sony’s Playstation VR is expected to run off its own gaming console. In the last two years alone, SONY has shipped more than 30 million PS4 units. Their Playstation VR device is expected to connect to the PS4 and provide an immersive gaming experience. SONY’s strategic intent via its VR offering is very clear. Provide value to its base of existing gamers and attract new gamers to its PS4/x platform. In a recent survey report released by FastCompany last month, SONY seems to have the most brand momentum when it comes to VR Offerings.

Although SONY has a lot of fan following among its established base of gamers, some of these folks have been burnt in the past by offerings that didn’t go anywhere such as SONY’s move into 3D gaming etc. If the Playstation VR is successful, it will be a gift for the existing PS4 gaming community and will provide SONY with a step up against its closest competitor Xbox. The bigger question is what percentage of the consumers that do not own a PS4 are willing to buy both a PS4 and a Playstation VR to get into the experience band wagon.

Given that the PS4 prices are falling (In Japan Price reduced by 12% last year), one can probably expect a combo pricing of the Playstation VR with a PS4 some where in the range of ($700 – $900) on par with Oculus and HTC .Sony’s team has expressed interest in keeping the VR device prices at the lower end in order to satisfy its existing customers and make it an attractive offering for new customers who have been sitting on the fence and also the folks that have not upgraded their consoles in a few years.

In terms of content, they have their own partnerships with Game producers and are not dependent on VRSE, MilkVR or SteamVR.

In Summary, the “Haves”, who already own a PS4 (30-35 million and growing) will definitely champion the PSVR because of marginal investment. The “Haves” who are on an older PS platform will have a choice of sorts. The more important issue is what percentage of the “Have-Nots” can SONY expect to capture via their VR offerings.

Although the strategic intent of SONY & SAMSUNG is quite clear, one needs to revisit Oculus. At the time, the $2bn acquisition was made, 25% of 13 – 17 year olds were leaving Facebook and joining up and coming social networks such as Whisper, Snapchat etc. Before the Oculus move was made, Facebook did offer $3bn to Snapchat which that was turned down by the company. In the recent survey from FastCompany, 79% of Generation Z is interested in VR.

Is the VR move from Facebook much more than just the gaming experience? Will the VR offering be energized at some point with other “Beyond Gaming” aspects in order to bring back the 12 – 17 year olds into its core social platform? I would wager a bet and say yes. If you are a Have-Not and absolutely love the gaming experience and also interested in “Beyond Gaming” offers, this will be a pretty sweet spot if you can make the investment commitment.

It is also important to note that Facebook has not had any experience on the product/hardware side of the equation. Setting up manufacturing alliances, distribution strategies, product support networks will be something new for the firm. There is definitely a lot of learning that will transpire from this experience.

Since Game offerings and Gaming consoles have never been the primary focus of Facebook, It will be important to see how they position the VR experience as a complement to its core offerings for its brand. Risky but very promising.

The HTC-Vive has developed a cult following in recent months. Their road shows were popular across the country. Infact, StarVR another key VR player followed on HTC’s footsteps with demos around the country showcasing it’s “Walking Dead” VR experience. HTC-Vive has one unique selling proposition that is different than the rest of the pack. If you are looking for a “Room size VR experience”, this is the platform! The Vive side of the alliance also offers close to 65 million existing gamers around the world. These “Haves” will choose between HTC-Vive and Oculus since the SteamVR content will be available on both the platforms.

In the recent quarters, HTC has had some financial troubles. That will be a risk moving forward and incremental investments into VR may be tough for the company if their launch is not very successful. Furthermore, their strategic intent is not abundantly clear as they are first and foremost a phone company and the current VR offering will not be helpful in increasing their handset sales. The VR play could also be a very successful diversification for HTC and if it is, then they will most definitely continue to prioritize this new product line.

In Summary, There are a lot of choices for both the“Haves” and the “Have-nots” in the months to come.

- Buy a Oculus themed PC and purchase the Rift. Some estimates peg the gaming PC at $1000 and the headset between $400 – 600. Experience your VR via content offerings from Oculus Home

- Buy a HTC Vive and game themed PC at $1000. Experience your room VR gaming experience via offerings from SteamVR.

- Invest in a PlayStation PS4 and Playstation VR at sub-$1000 and still experience a superior OLED display, 100’ FOV, Games at 120 FPS

- Wait to invest in a system such as FOVE ($350 – $500) and upgrade current PC with a graphics Card and other minimal upgrades to leverage SteamVR and experience eye tracking based games.

- Wait for other high-end offerings from players such as STARVR

- Continue on with Gear VR and expect cool offerings from Samsung

- Decide to Wait it out and continue with Cardboard for VR.

Interesting choices for sure! It will be exciting to see what key factors go into establishing the order winning criteria for VR and what soapy fun, betrayals, manipulations and bitch slap or two play out as the industry marches towards its $20 billion milestone.

Me, I’m still a “Have-Not” and will wait for your feedback to help me decide on who gets my money!

Be the first to comment on "The Have’s and the Have-Nots of Virtual Reality"