On the heels of the news surrounding delayed product launch from HTC-VIVE, there was news this week of a major technological breakthrough from the company. Cher Wang, HTC CEO while speaking during a forum in Beijing, said that the company will make a major announcement at the Jan CES following a “very, very big technological breakthrough” achieved by Valve and HTC within the past couple of weeks. The reason for the delay was attributed to this breakthrough.

While the recent speculative frenzy around the proposed breakthrough has centered around potential 4K resolution on the HMD to front facing camera unit, a key takeaway for me is that HTC is careful, albeit very careful in how it positions the product in the new market. They are really interested in giving their customers a solid product that lives up to the expectations.

The announcement came as the company was preparing for its developers forum in Beijing this week.

Why China? What are some of the factors driving HTC’s product positioning in the Chinese gaming market? Are there synergies that can be harvested via strategic partnerships for the china market? Does HTC have a clear advantage in positioning itself in this market?

Chinese Gaming Market

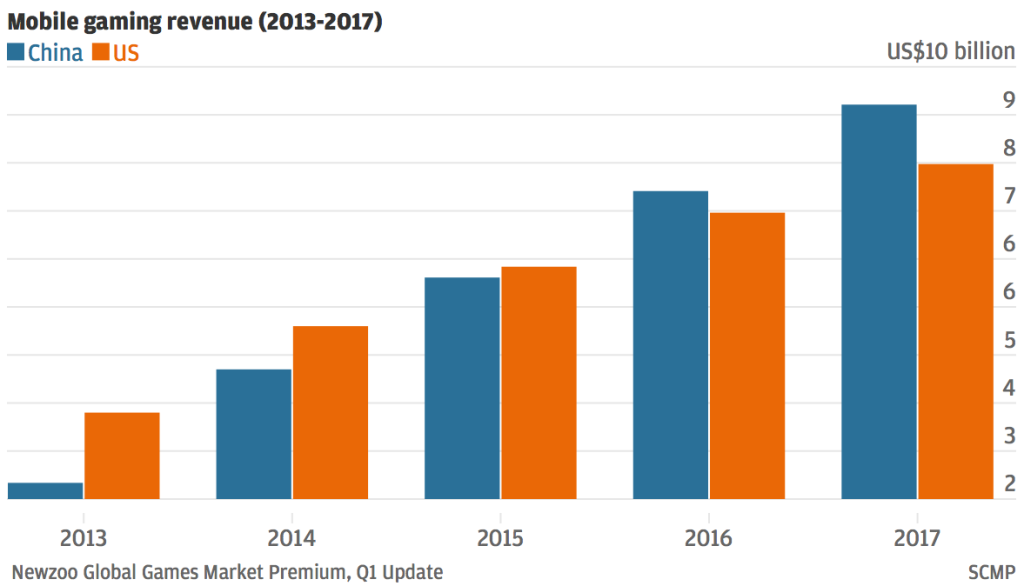

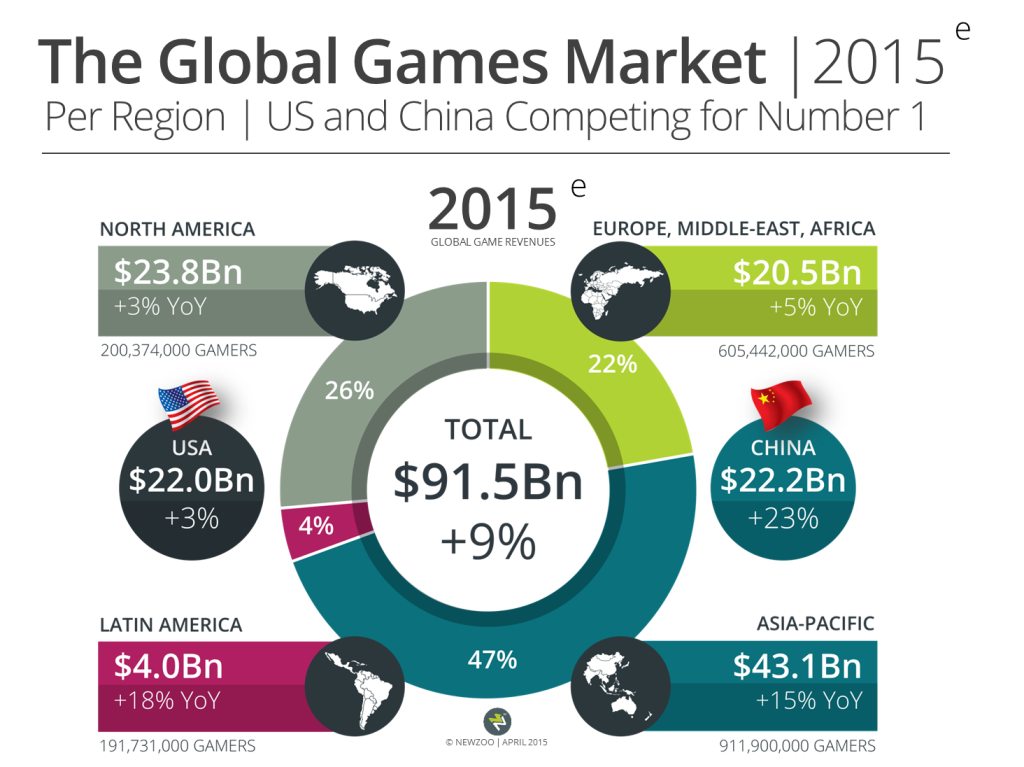

In the last two years, there has been lot of changes in the gaming market in China. First and foremost was the regulatory change in July 2015, that lifted a 14 year ban on gaming consoles allowing players such as SONY and Microsoft to operate more freely in the market space. Established gaming houses such as Ubisoft and EA have also opened offices in China. Interstingly, in recent times both SONY and Microsoft have struggled with the sales of their consoles in this market. Most of the existing gaming hardware is run off PCs since consoles were banned for such a long time. This gaming market is well versed with PC’s, graphics cards and in general solutions on PC. The market projections are also pretty appealing for the overall gaming space in China. Mobile based gaming is expected to grow and this should be appealing to Samsung Gear VR.

One cultural aspect that has probably influnced the slower sales numbers is due to the way the consumers experience the games. The rise of the “Wang-ba” aka Internet cafes in the last decade has allowed the gamers to experience games in the internet cafes as opposed to owning their own consoles. It’s more of a social experience in which people get to enjoy drinks and share stories with friends while playing the games as opposed to gaming by yourself.

Wang-ba’s provide an escape from family life for the younger ones and escape from life’s drudgery for those out of school. Among industry watchers, a huge question is whether or not the current crop of Asians will continue to game into their late twenties and early thirties – much like the shift we saw in the US and Europe in the late nineties.

In 2014, there were plans announced to build a gaming stadium costing $2.8 billion, known as the V-Zone in Hengqin island. The first phase of the park’s development is expected to be complete in 2017 and will cost roughly $480 million. Overall the gaming market is huge.

Source: VentureBeat.

This clearly shows the full economic potential of this market place! Now if you can imagine a stadium full of people playing a game like EVE: Valkyrie and competing in the future, you can begin to understand the appeal that VR may have in this market!

Who is the Chinese Gaming Customer?

The post 90’s generation is the generation of choice for this gaming market place. This is also the generation in China that has seen some massive changes and is open to new experiences. In the first quarter of 2015, WeChat, TenCent’s largest community portal, had more than 480 million active users on the Mainland. Alibaba’s 24-hour Singles Day promotion, targeted toward lovelorn youth, generated more than $10 billion in revenue !

Inspite of the dramatic changes, China’s new generation remains conflicted. On one hand, individuals want to leave their mark – today – by pursuing their passions much like their counterparts in western society. On the other, they are held back by a regimented society.

They are new minds in an old world and this can influence their gaming choices.

The Post 90s generation seeks brands that resolve the tensions between a quintessentially Chinese projection of status or power and the youthful celebration of now.

Games with Chinese take on Eastern Mythology such as Zhuxion have become immensely popular. Zhuxion is the first truly 3D MMORPG made exclusively by a Chinese developer, Perfect World, with their proprietary technology. What’s more, Zhuxion was made in half a year – that’s less than a fifth of the development time of the average MMORPG.

60% of gamers in China play 3D games, while another 17% play 2D graphic games. As a result, companies such as Perfect World have been focusing their energies in these areas. For example, Perfect World introduced its 3D MMORP mobile game Forsaken World to attract gamers.

Due to the customer’s preference for 3D MMORP games, the market provides very attractive economics for companies trying to position Virtual reality games and consoles since virtual reality based games are more of a natural progression from the popular 3D games.

According to industry reports, average player expenditures range from 100 RMB ($15) a month for Mo Shou Shije (you might know it as World of Warcraft) to between 400 and 1000 RMB ($57 – $143) for the free-to-play costume-rich Hot Dancer, with most popular free-to-play online games at around 200 – 400 RMB ($29 – $57).

Gaming Related Corporate Investments

In this space, There have been multiple corporate structural changes over the last year in China. The first and foremost is around taking the company private. After the stock market struggles, large mainland gaming companies such as Shando Group and Perfect World decided to become private entities . Gaint Interactive group also went private in 2013 via a private deal valued at $2 billion USD.

This will allow them more fleixibility in how they execute on their forward looking strategies & choose how to invest their resources. Most of the these firms have been sitting on the fence when it comes to developing VR content at this time. It is however only a matter of time that some of these local gaming corporations will enter the VR gaming space.

In terms of investments into VR, 2015 also saw some action. China Media Group joined Disney in the $66 million funding for JauntVR. There are over more than 100 virtual reality HMD manufacturers in China and you can get a sense of this when you search for HMD devices on Alibaba. The Chinese internet company has already invested in companies such as AltSpace VR and Epic games. Last year also saw the investment from Shando group into uploadVR, which is one of my favorite source of news in the space of virtual reality. This year also saw the investment of $4.3 million by Youzu interactive in WakingApp.

HTC VIVE’s China Positioning Strategy

HTC’s approach to this lucrative Chinese market looks very promising. Given the appeal of PC based gaming in a market where users love 3D gaming, HTC VIVE’s PC based solution will definitely be a natural transition for the existing gaming community. As graphics card prices drop over the next few years, the Price point for a HTC VIVE HMD along with the gaming PC may become more appealing. In the meantime, the company can still capitalize as a premium brand in the VR gaming space.

Facebook is not allowed in China. That in itself may pose challenges to Oculus gaining large market share in China as the VR market evolves in the next 2 to 3 years. SONY’s PS4 growth has been stumbling in the china market over the last few years. A combination of price point and non PC based solution could be some of the reasons attributed, which pretty much leaves the next door HTC with an early advantage.

Since HTC is PC based, it definitely will be perceived as an attractive choice by the existing gaming community as opposed to Playstation VR that require the native SONY Console (PS4).

HTC also understands that one of its unique selling proposition is the room scale VR gaming, which requires 15 by 15 ft space. In cities, where the average apartment size is 500 sq ft (http://reut.rs/1lpqmWT), this may not be a strategic selling point.

This is where the strategic partnership with a local player becomes important. HTC is also promoting its VR headset by partnering with Hangzhou Shunwang Technology Co., a mainland Chinese Internet cafe operator, to gain access to the 100 million people who frequent Internet cafes in the huge China market. This is definitely a symbiotic play for both the parties in the strategic relationship.

Since some of the internet cafes are loosing customers due to the popularity of mobile games, I’m certain some of these could be easily retrofitted to provide 15 by 15 ft room scale VR experiences with multi player gaming contests held on a regular basis.

The popularity of VR based gaming will provide additional revenue streams to these internet cafes and in turn will help HTC make deeper inroads into the local gaming market by establishing its brand. As PC and HMD prices fall in the coming years, this brand premium if successful will definitely translate into promising revenue streams.

Local game developers understand the consumer better than the western production houses. By attracting local VR develoers in markets such as Shanghai and Beijing, they will be able to source local gaming content in the next few years. Who knows there might be a Perfect World type company hidden in this emerging indie talent. This is perhaps one of the reasons why HTC VIVE has focused so much on the talent in Beijing and Shanghai over the last couple of years.

If HTC is able to generate the leadership in this nascent VR gaming market in China, it will definitely serve as a game changer for the company, given it’s bleek financials. There is a lot riding on this initiative for HTC so we hope that Cher Wang really blows off our minds with the announcement at CES around this breakthrough. That will indeed be sweet relief for the HTC VIVE fans that are beginning to get a little impatient with the product lauch delays.

Be the first to comment on "HTC VIVE & China Gaming Market Opportunity"